What Are Range Bars and Why Futures Traders Use Them

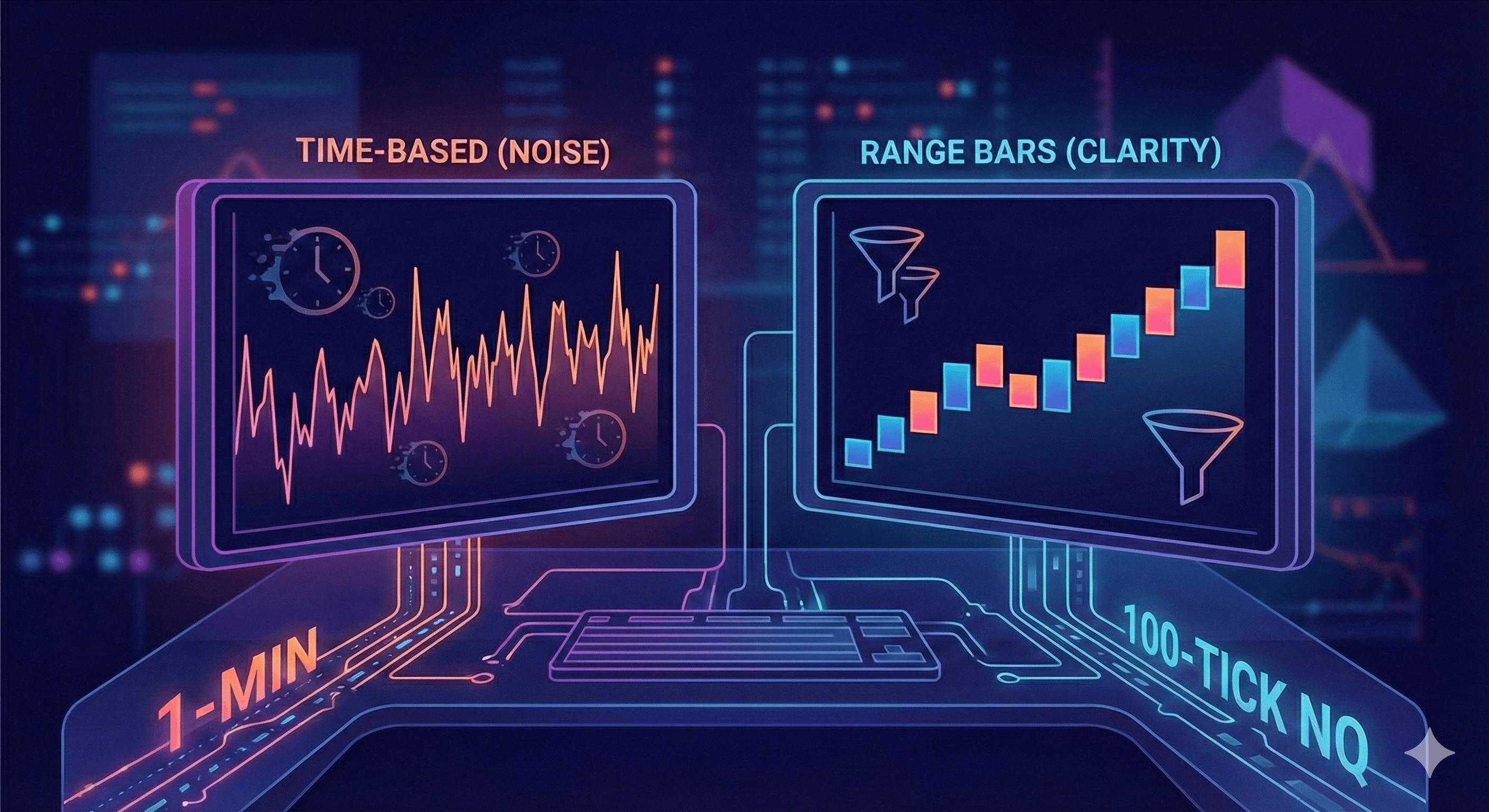

Most futures traders start with time-based charts—1-minute, 5-minute, whatever feels right. But if you've ever watched a candle form during low-volume chop and thought "this tells me nothing," you're not alone.

Range bars solve this problem by ignoring time entirely and focusing on what actually matters: price movement.

In this guide, you'll learn exactly what range bars are, how they work, and why so many futures traders—especially scalpers—have made the switch.

What Are Range Bars?

Range bars are a type of chart where each bar represents a fixed amount of price movement rather than a fixed amount of time.

- A 100-tick range bar on NQ only prints a new bar when price moves 100 ticks (25 points)

- During fast markets, you'll see dozens of bars form per minute

- During slow, choppy markets, you might wait several minutes for a single bar

This creates a chart that automatically adapts to market conditions—giving you more information when it matters and less noise when it doesn't.

How Range Bars Filter Market Noise

Time charts have a fundamental flaw: they give you a bar whether anything meaningful happened or not. During lunch hour chop, you're still getting candles—but they're mostly noise.

Range bars only print when price has moved enough to matter. This means:

- Fewer false signals from indicators

- Cleaner trend identification

- More actionable setups

Why Futures Traders Prefer Range Bars

Futures markets—especially NQ and ES—have distinct characteristics that make range bars particularly effective:

Cleaner Signals in Normal Volatility

Range bars shine during regular trading sessions. During market open or typical intraday moves, they give you more granular information than time charts without the noise.

A word of caution: During major news events like FOMC announcements or NFP releases, smaller range bars can show significant gaps and slippage. If you trade news events, either sit out until the bars start printing smoothly again, or switch to a much larger range bar size (100 tick on NQ, for example) to handle the extreme volatility.

Low Volume Periods

During lunch hour or overnight sessions, range bars stop printing meaningless bars. Your indicators stop giving false signals.

Scalping

If you're in and out of trades quickly, range bars give you more granular information during fast moves without cluttering your chart during pauses.

Choosing Your Range Bar Size

The "right" range bar size depends on:

- Instrument: NQ moves faster than ES; you'll need different sizes

- Trading style: Scalpers use smaller ranges; swing traders use larger

- Session: Some traders adjust size based on expected volatility

Common starting points:

- NQ: 20-100 tick range bars

- ES: 8-16 tick range bars

- GC (Gold): 10 tick range bars

- CL (Crude): 9 tick range bars

Range Bars and Indicators

Here's something most traders don't realize: most popular indicators were designed for time-based charts. When you slap RSI or MACD on a range bar chart, the calculations don't work the same way.

Some indicators adapt well. Others give you garbage signals.

This is why traders who switch to range bars often need to rethink their indicator setup—or find indicators specifically designed for range bar trading.

Getting Started with Range Bars

If you want to try range bars:

- Set up a range bar chart on TradingView — TradingView supports range bars on most futures instruments

- Start with a moderate size — For NQ, try 40-tick range bars as a starting point

- Compare to your time chart — Run both side by side for a few sessions

- Adjust based on your style — Scalpers go smaller, swing traders go larger

Key Takeaways

- Range bars are based on price movement, not time

- They automatically filter noise during slow markets

- Futures traders benefit from their adaptability to volatility

- Most indicators weren't designed for range bars—choose carefully

- Start with a moderate size and adjust based on your trading style

Continue Learning

Ready to try range bars with indicators designed specifically for them? Check out Range Bar Rider—built for trend confirmation on range bar charts.

Or join the email list for weekly trading insights and range bar setups.

Written by

Joey