MNQ 100RIntraday Strategy

A disciplined 2-trade-per-day strategy with only 3 possible outcomes. No guessing. No overtrading. Just rules.

What You Need

MNQ

Micro Nasdaq Futures

100R

Range Bar Chart

HAMA Indicator

See options below

1 Contract

Position Size

Choose Your Indicator

This strategy works with HAMA-style candle indicators. Start free or upgrade for more features.

NSDT HAMA Candles

A free, open-source TradingView indicator that provides the core HAMA candle functionality needed for this strategy.

- ✓Heiken-Ashi Moving Average candles

- ✓Multiple MA types (EMA, SMA, WMA)

- ✓Customizable colors and settings

- ✓Gradient color scheme option

Range Bar Rider

My enhanced version with additional signals and settings designed specifically for range bar trading.

- ✓Everything in NSDT HAMA Candles

- ✓Additional buy/sell signals

- ✓Trend strength indicators

- ✓Advanced customization options

- ✓Optimized for range bar charts

The Strategy

Identify the Trend

Bullish trend — Look for long entries only

Bearish trend — Look for short entries only

No trend yet — Stay out and wait

Wait for the Pullback

Once a trend is established, wait for a range bar that:

- 1Pulls back above/below the Moving Average

- 2Stays the same trend color (does NOT change)

- 3Closes in the direction of the current trend

Execute the Trade

On the close

Enter as soon as the signal bar closes in the trend direction

100 ticks

Just above/below the signal bar

200 ticks

1:2 Risk-Reward ratio

Why range bars? They make defining your risk simple — a 100 tick stop and 200 tick target is all you need.

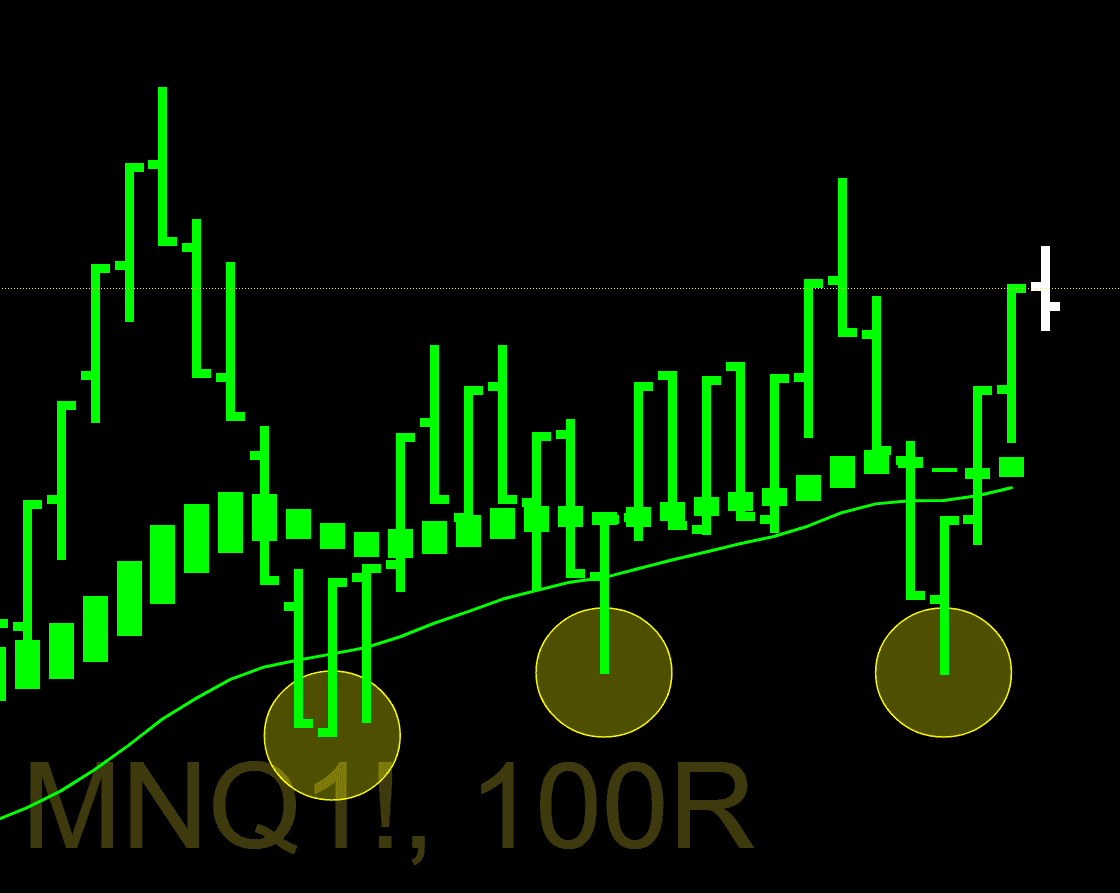

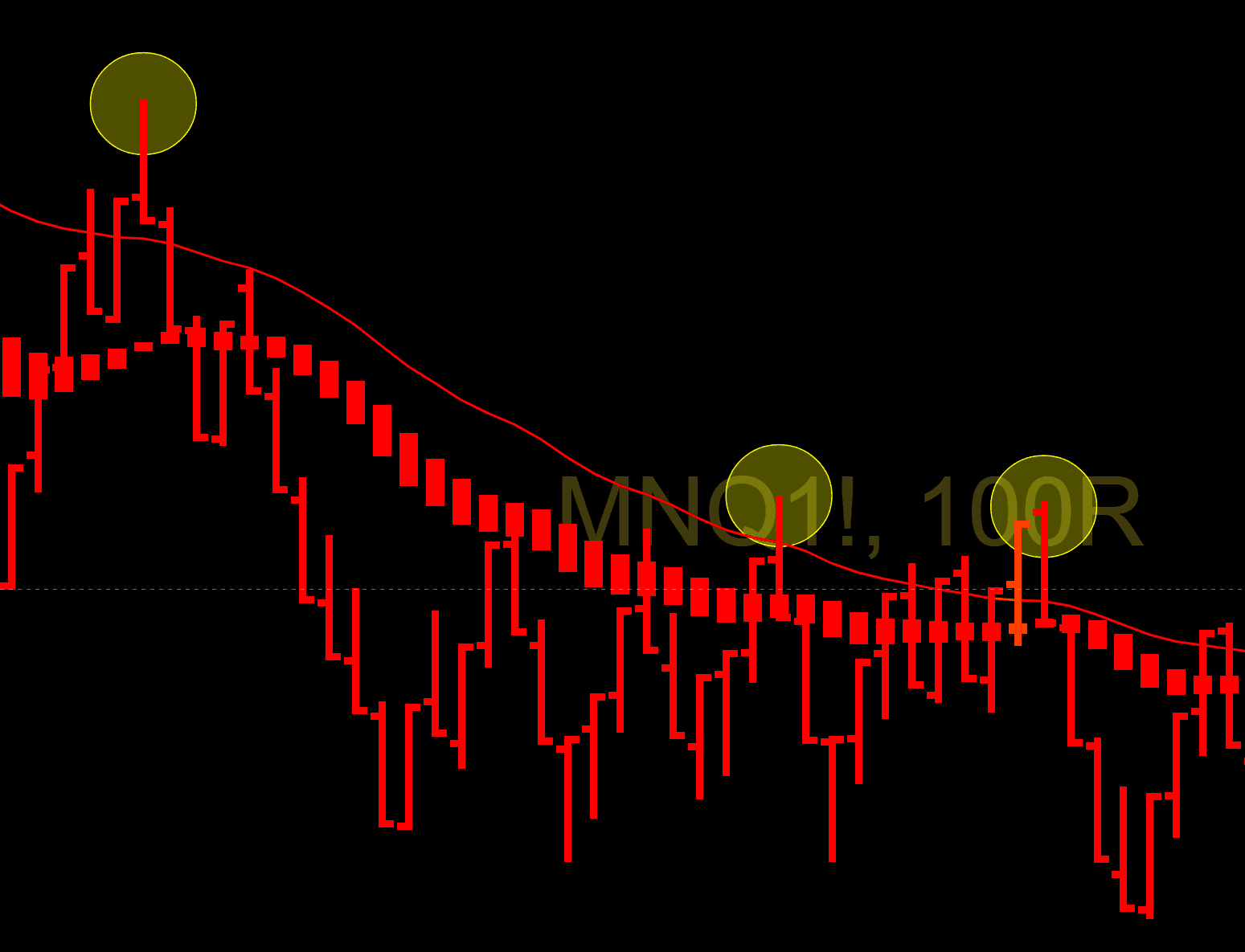

See It In Action

Real examples of the strategy on MNQ 100R charts. The yellow circles highlight valid entry signals.

Long Entries

Green bars indicate bullish trend. Enter long when price pulls back to MA but closes bullish.

Short Entries

Red bars indicate bearish trend. Enter short when price pulls back to MA but closes bearish.

Only 3 Possible Outcomes

With 1 MNQ contract and strict daily limits, your day ends one of three ways. No exceptions.

- • Maximum 2 trades per day — no exceptions

- • Once you hit your result (win or lose), walk away

- • No revenge trading, no "one more try"

Ideal for $25K Prop Accounts

Most $25K prop firm accounts have a maximum drawdown of $1,000. This strategy is designed to protect that account.

You would need 10 consecutive losing days (20 losing trades in a row) to hit the max drawdown. With even a modest win rate, that's extremely unlikely.

Want More Signals?

While this strategy works with the free NSDT HAMA Candles, the Range Bar Rider adds additional signals and settings to help you find even more opportunities.